fsa health care limit 2021

For spouses filing jointly each spouse can elect up to the health care max in the year in 2022 that would be 2850 2850 5700 household total. You qualify for a subsidy on a Covered California plan.

What Is An Fsa Unitedhealthcare

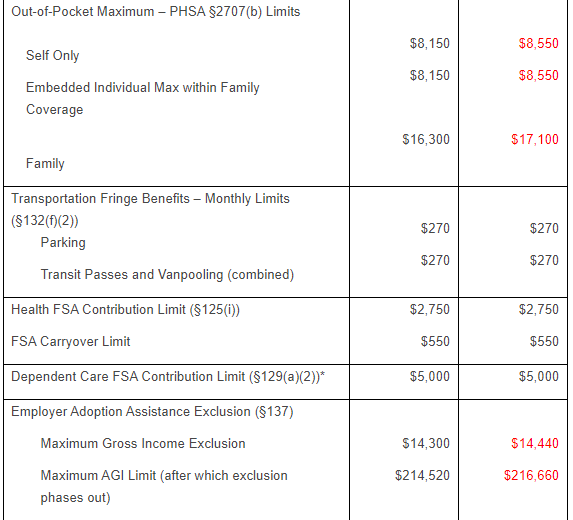

The IRS also announced in Revenue Procedure 2021-45 that the carryover of unused health care FSA amounts increases from 550 to 570.

. Unlike the health FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by. Get a free demo. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married.

You also qualify for the. For adults the following Covered California income restrictions apply. On October 27 2020 the IRS announced the FSA limits for 2021.

March 15 2021. Attached are briefing materials and Revised State Income Limits for 2021 that are now in effect replacing the previous 2021 State Income Limits. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022.

The irs sets dependent care fsa contribution limits for each year. For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of. And since you can carry over up.

138 400 of FPL. However as discussed below. Elevate your health benefits.

Plus if you re. Beginning July 1 2022 a new law in California increased the asset limit for Non-Modified Adjusted Gross Income Non-MAGI Medi-Cal programs. Ad Custom benefits solutions for your business needs.

Employers may allow participants to carry over unused amounts IR-2021-40 February 18 2021 WASHINGTON The Internal Revenue Service today provided greater. This pre-tax benefit account helps you save on eligible out-of-pocket dental and vision care expenses while taking advantage of the long-term savings power of an HSA. For the 2021 income year it is 2750 26 USC.

For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of. It remains at 5000 per. Single and joint filers.

However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to be. If youre married your spouse can put up to 2850 in an FSA with their employer too. FEDERAL PUBLIC CHARGE RULE.

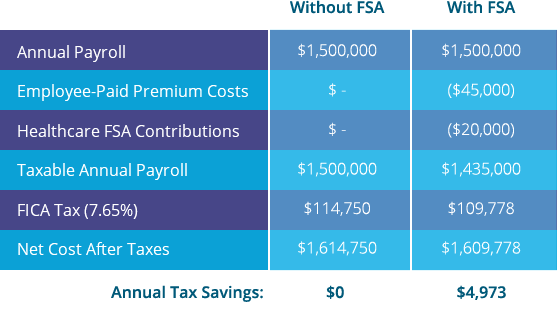

The money you contribute to a Health Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck. IRS Announces 2021 Health Care FSA Limits Employee. Health 8 days ago Included in the announcement is the inflation adjusted 2021 limits for Health Care flexible spending accounts.

The irs sets dependent care fsa contribution limits for each year. Dependent Care Fsa Limit 2022 Irs. 125i IRS Revenue Procedure 2020-45.

You can use funds in your FSA to pay for certain. The health FSA contribution limit is established annually and adjusted for inflation. Health Care FSA Maximum Plan Limit The pre-tax salary reduction limit for Health Care FSAs will remain at 2750 for plan years on or after January 1 2021.

Ad Professional Benefits Services. Income limits have been updated in. FSAs are limited to 2850 per year per employer.

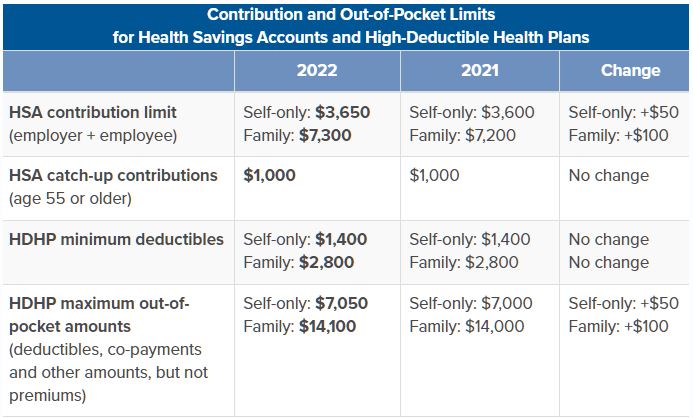

New Limits for the Aged Blind and Disabled Federal Poverty Level Program for 2021. This is an increase of 100 from the 2021 contribution limits. Limits remain unchanged at 2750 when you make pre-tax contributions to a health FSA account.

The health FSA contribution limit will remain at 2750 for 2021. 138 to 150. Dependent Care FSA Limits Remain the Same for 2021.

Easy implementation and comprehensive employee education available 247.

/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

Does Money In A Flexible Spending Account Fsa Roll Over

![]()

Covid Relief 2021 Implementing Fsa Rule Changes On Vimeo

What Is The Difference Between A Medical Fsa And An Hsa Healthinsurance Org

2022 Hsa Contribution Limits 2 Core Documents

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

Flexible Spending Account Fsa Faqs Expenses Limits Plans More

Fsa Carryover Lawley Insurance

Flexible Spending Account Fsa Ameriflex

Fsa Mistakes To Avoid Spouse Dependent Rules

What Happens To Unused Fsa Funds Kbi Benefits

2022 Health Fsa Contribution Cap Rises To 2 850

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

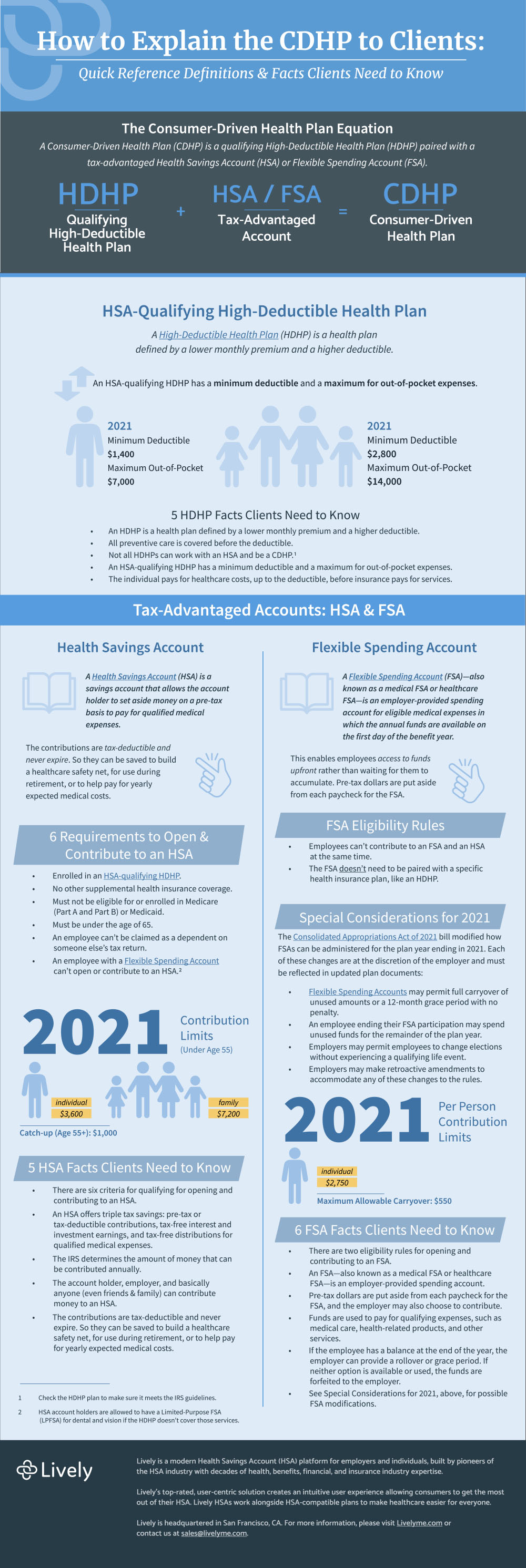

Infographic How To Explain The Cdhp To Clients Lively

2021 Health And Fringe Benefit Limits Lexology

Health Fsa Limit Will Remain The Same For 2021 Pierce Group Benefits

Fsa Hsa Contribution Limits For 2022 Stratus Hr

Upmc Irs Announces Hsa Fsa And Hdhp Contribution And Oop Limits For 2021 Neishloss Fleming

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health